Secure Your Future While Saving Animals’ Lives

Learn how a Charitable Gift Annuity can provide you with reliable income while creating lasting change for animals.

Your Impact for Animals Will Continue Beyond Your Lifetime

A charitable gift annuity can be a powerful way to provide for you and/or a loved one while helping animals.

When you create a charitable gift annuity with PETA, you’re not just securing your financial future—you’re helping to create a world where all animals are treated with the respect and compassion they deserve. Your legacy will live on through every animal saved from suffering.

Our team would be happy to speak with you about the many ways you can benefit from this type of gift while ensuring animals receive protection and advocacy for years to come.

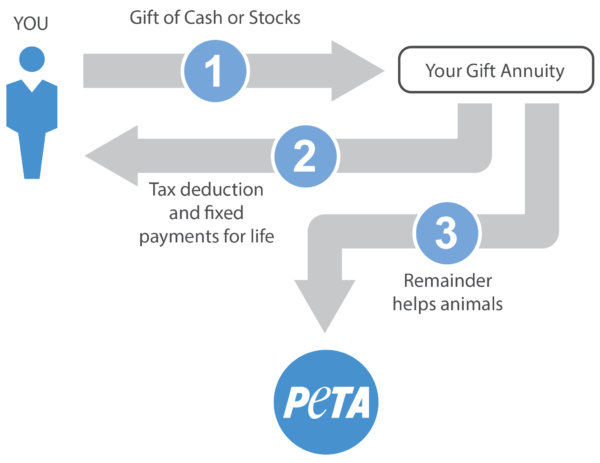

How a Charitable Gift Annuity Works

- You donate cash or appreciated securities worth $10,000 or more to PETA. In return, you and/or another beneficiary will receive fixed payments for life.

- You may be eligible for an immediate U.S. federal income tax deduction and, in the case of stocks, savings on capital gains taxes.

- Your payment rate is based on your age (payments start at age 60 or later) and will never change.

- A portion of your payments will be tax-free.

- The older you are — or the longer you defer starting your payment — the higher your payments will be.

Benefits of a Charitable Gift Annuity

Payment rates can now go as high as 10.1 percent, depending on your age (you must be 60 or older). If you don’t need the income immediately, you can schedule payments to begin at least one year after your donation. The longer the deferral period, the higher your payment rate.

Why a charitable gift annuity is a good idea:

- Guaranteed fixed lifetime income at new higher rates with no stock market risk

- Current income tax charitable deduction

- Possible tax-fee income

- Potential estate tax savings

- You have the satisfaction of knowing that your gift will help create a better future for animals.

Sample rates for a one-life immediate charitable gift annuity

| Age | Lifetime Annuity Rate | % of Payment Tax Free |

|---|---|---|

| 65 | 5.7% | 77.7% |

| 70 | 6.3% | 76% |

| 75 | 7.0% | 71.7% |

| 80 | 8.1% | 67.4% |

| 85 | 9.1% | 62.4% |

| 90 | 10.1% | 57.1% |

It is gratifying to support PETA while also being able to count on additional income for retirement.

I would like to learn more about creating a

charitable gift annuity with PETA.

This information is not intended as legal or tax advice. For such advice, please consult an attorney or tax advisor. Figures cited in any examples are for illustrative purposes only. California residents: Annuities are subject to regulation by the State of California. Payments under such agreements, however, are not protected or otherwise guaranteed by any government agency or the California Life and Health Insurance Guarantee Association. Oklahoma residents: A charitable gift annuity is not regulated by the Oklahoma Insurance Department and is not protected by a guaranty association affiliated with the Oklahoma Insurance Department. South Dakota residents: Charitable gift annuities are not regulated by and are not under the jurisdiction of the South Dakota Division of Insurance. Please request our Gift Annuity Disclosure Statement for additional information.