Gifts That Pay You Income

Supplement your retirement income while you protect animals for years to come.

If you’re thinking about this gift, we recommend consulting your financial advisor and PETA to select the gift that’s right for you.

Charitable Gift Annuities

If you would like to receive significant tax benefits while making a gift that pays you—and/or a loved one—fixed payments for life, consider a PETA charitable gift annuity.

Benefits to you include:

You’ll receive reliable payments that never change.

You may save on taxes.

You are eligible for an immediate tax deduction.

You have the satisfaction of knowing that your gift will help create a better future for animals.

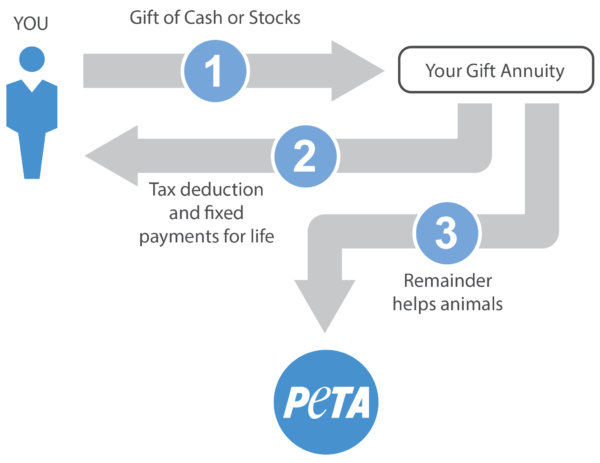

How Does It Work?

- You donate U.S.-generated cash or securities worth $10,000 or more to PETA. You must be age 60 or older when your payments start.

- You (and/or a second beneficiary) receive payments for life in return.

- Your payment rate is based on your age and will never change, no matter how long you live or how the market fluctuates.

- If you don’t need income right away or haven’t reached age 60, you can defer your payments for one year or more. The longer the deferral period, the higher your rate will be.

- Make your gift by December 31, and you may be able to reduce your current year tax burden.

- Avoid some capital gains taxes when you use appreciated securities to make your gift.

-

If you are age 70.5 or older, you may be able to make a one-time Qualified Charitable Distribution (QCD) of up to $55,000 from your IRA to fund a gift annuity.

Calculate Your Impact

Charitable Remainder Trusts

A charitable remainder unitrust with PETA can provide you and/or other beneficiaries with income for life or for a fixed number of years. You will receive an immediate income tax deduction for a portion of your contribution to the unitrust and savings on capital gains taxes (if you fund your trust with appreciated assets). You will also have the satisfaction of making a significant gift that benefits you now and PETA later. With this type of gift you can:

- Receive lifetime income for yourself and/or a loved one.

- Sell your appreciated securities or real estate and avoid capital gains tax on the transfer.

- Receive an income tax deduction and reduce or eliminate estate taxes.

- Convert low-yield or non-income producing assets into a lifetime stream of income.

A CRT can be established using a wide variety of assets, including: cash, appreciated publicly traded stock, real estate, closely held stock or oil, gas and mineral interests. Contact us to discuss your situation.

Questions? We’re here to help.

Tim Enstice

Vice President of Legacy Gifts, PETA Foundation

501 Front St., Norfolk, VA 23510

757-962-8213